- Elliot Lin

- Jun 5, 2020

- 5 min read

Updated: Aug 31, 2022

A developer just sold off all its remaining units at discounts of up to $500k to avoid ABSD

The remaining 16 unsold units at 38 Jervois were snapped up in just 2 days after developer Prominent Land dangled discounts worth up to 25% off list prices [Photo: UppMarketSG]

Since 2011, developers have been subject to an Additional Buyers’ Stamp Duty (ABSD) Housing Developers’ Remissions Rule - one which requires them to sell off all units in a project within 5 years from acquisition date of the land or be penalized with a painful 15% in ABSD.

This amount was further increased to a hefty 25% in July 2018. Factoring in interest, this works out to about 31.25% in total – an amount which could possibly make the project a loss making investment for the developer!

Prominent Land’s move to sell its remaining 16 units in 38 Jervois at discounts ranging between $275k to $547k was made precisely to avoid paying this ABSD and to “move on from this project” (in their own words).

38 Jervois is a boutique condominium project with just 27 units, built on a 1378sqm plot of land which was once a sprawling bungalow in the upmarket District 10 Jervois landed housing enclave. Prominent Land bought the land for $25 million back in February 2015 and launched 38 Jervois, initially selling units in the region of $2400++psf.

Its take up rate has been rather slow since then, with only 11 units sold over 4 years (the last unit being sold almost a year ago in June 2019.

With their 5 year deadline looming in August 2020 (even after being given an additional 6 months in lieu of the Covid-19 crisis), Prominent Land made the bold decision to throw out the discounts in the hope of ridding itself from the impending liability.

Earlier Buyers won't be pleased at all...

Of course, if you were one of the 11 buyers who bought a unit in 38 Jervois earlier, you will be fuming. By selling more than half of the project’s units at a de-facto 20-25% discount, they have instantly eroded the value of your new prized possession by that same amount!

To put that in numbers, consider…

Mr Chan: bought unit A in 2017 @ $2,400psf

Mr Lee: bought unit B in 2020 with the massive discount @ $2100psf

If Mr Lee wants to sell his unit today – he can sell it as low as $2300psf and still enjoy a decent profit. If a few “Mr Lees” all decide to cash out at $2300psf, it creates a ‘market value’ of the property at – yep, $2300psf - putting Mr Chan in a loss position.

Surely Mr Chan must be kinda upset at the developer’s actions?

It’s a business decision – is it the sign of things to come?

Well, in the business world it’s every man for himself. At the launch Prominent Land priced 38 Jervois at that level hoping to sell, and 11 buyers believed it was the right price and bought in.

However as market conditions evolved, that price level didn’t hold and so it became all about the numbers:

To dispose of remaining units (with the discount) merely represented reduced income

To hold on to the units would have cost Prominent Land $4.8 million in ABSD plus the headache of deciding what to do with the unsold units - in a time of a brewing property glut

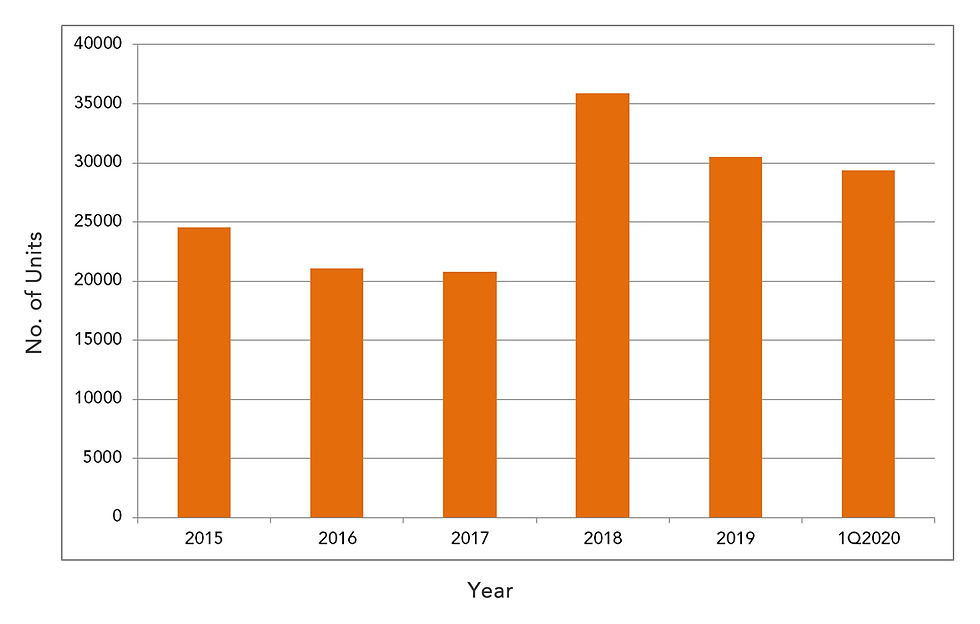

Chart: number of unsold private residential units with planning approvals (Source: data.sg)

According to official data, there are 29,396 unsold private residential units and 52,481 private residential units in the pipeline as of 31 March 2020. Many observers believe the numbers show an oversupply which will take almost 7 years to clear based on current take-up levels (I will be discussing the subject of oversupply in my next editorial piece).

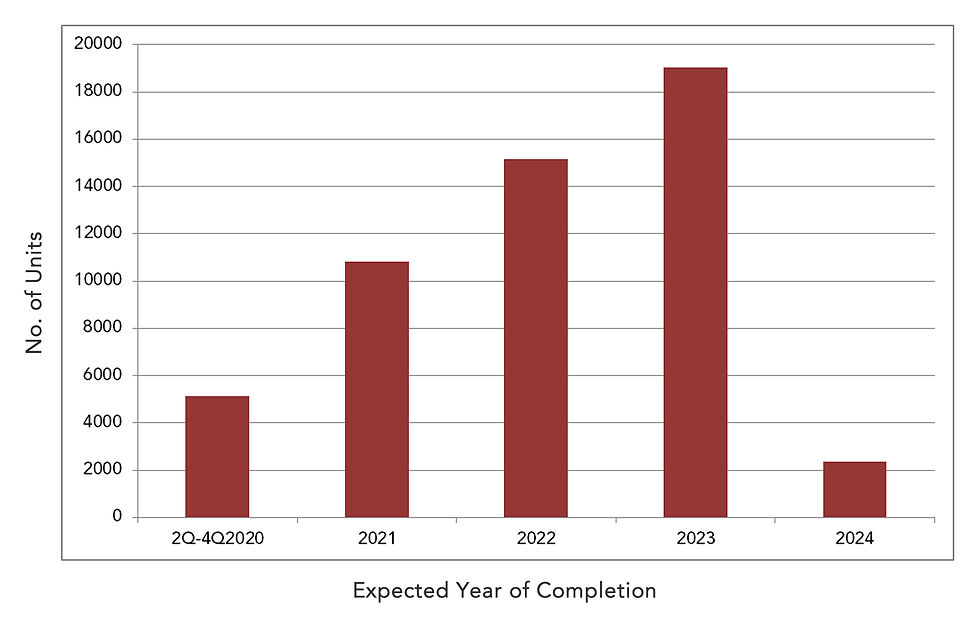

Chart: private residential units in the pipeline (sold & unsold) as at 31 March 2020 by expected year of completion (Source: data.sg)

7 years: extends past the 5 year deadline which most projects have to sell off all units, or face the prospect of the hefty ABSD charge.

Will developers therefore be pressured to do what Prominent Land did?

What other options do developers have?

To put things in perspective, developers have other options to manage their stock in face of the tight ABSD remission conditions.

In smaller projects, some developers have sold off remaining units to its directors and shareholders who either rent out the units or hold on to them until a better time to sell – Far East Organization is known to be one of them.

Many of the larger projects feature periodical promotions and put up ‘Starbuy’ units to draw buyers sitting on the fence back in and clear off their less desirable units at a discount.

Some developers also play the emotional game and do it the other way – gradually increase prices from launch till sell-out to create the FOMO (fear-of-missing-out) effect

Many developers have also begun incentivizing property agents to swing buyers over to their projects with aggressively high commission rates akin to the price of a luxury car each (likely explains the thousands of ads on social media and in your mailbox!) – Take for instance the developers of Parkwood Residences are paying agents up to 6% commission

There have also been calls for the government to temporarily ease ABSD remission conditions. In December 2019 CDL’s CEO Sherman Kwek made a public plea to lengthen the deadline to “7 or even 10 years” to reduce the pressure on developers to build-and-sell quickly. He suggested that Singapore’s property glut is a consequence of these measures.

So, is it risky to buy a new launch now?

There isn't an absolute answer to this question. Many of us know it’s a difficult trade-off waiting out hoping for a discount while instead losing your options…it’s like waiting in a supermarket for staff to paste a “50% discount” sticker on your desired sushi tray, only to see another customer grabbing it before the time due.

Perhaps what we as buyers can do today when considering a project is to look at the most basic indicators:

Are units in this project moving at a healthy pace?

How far away is the 5-year deadline for ABSD remission?

For example, a project that sells merely 2-3 units a month but has hundreds of units and more than 50% of its stock remaining will definitely be a risky pick (if it wasn’t hotcakes at the start, why will it be hotstuff at the end?).

Also be wary of property agents that pile pressure on you with anxiety-inducing claims such as... “the developer is going to raise the price next month!”.

Think: why would any developer raise its price if demand is weak (economic fundamentals, darling!).

At the end of the day, what happened with 38 Jervois has so far up to now been a one-off and although it remains to be seen whether other developers will do likewise in the near future, it should not cause too much worry for buyers.

As long as you know you’ve made a careful decision to go ahead with a buy, believe in your choice and whatever happens after that – it’s all God’s will.

Comments